You are here

Home 🌿 Marijuana Business News 🌿 Couche-Tard makes strategic investment in cannabis retailer Fire & Flower 🌿Couche-Tard makes strategic investment in cannabis retailer Fire & Flower

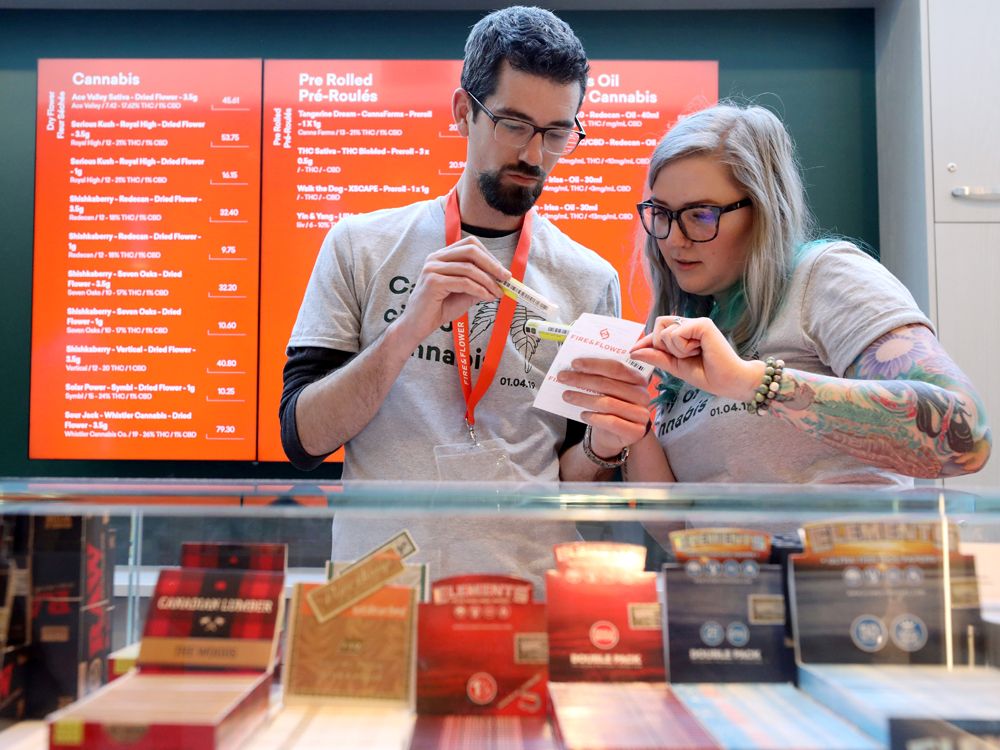

Giant Quebec-based convenience store owner Alimentation Couche-Tard Inc. is investing in cannabis retailer Fire & Flower Holdings Corp. of Edmonton to spur its “aggressive growth.”

Couche-Tard is paying almost $26 million for a 9.9 per cent stake in the cannabis seller that includes warrants to increase its ownership to 50.1 per cent, according to a statement by the owner of Circle K stores.

The investment allows Fire & Flower to expand from the 23 cannabis outlets in Alberta, Saskatchewan and Ontario that it operates or licenses, Couche-Tard said.

Couche-Tard has nearly 10,000 stores across North America and another almost 5,000 from Scandinavia to New Zealand, making it the largest convenience store owner in the U.S. and one of the world’s biggest retailers.

The investment comes as major investors are piling into the sector less than a year after Canada legalized marijuana and many U.S. states have allowed its medical use. Global spending on legal cannabis is expected to grow by 230 per cent to US$31.3 billion in 2022 compared to US$9.5 billion in 2017, according to Arcview Market Research and BDS Analytics.

The investment in Fire & Flower “will enable us to leverage their leadership, network and advanced digital platform to accelerate our journey in this new and flourishing sector,” Brian Hannasch, president and chief executive officer of Couche-Tard, said.

Fire & Flower gets Couche-Tard’s leadership team, financial strength and international footprint that will provide “outstanding opportunities for aggressive growth,” CEO Trevor Fencott said.

The Couch-Tard investment is in the form of debentures that will mature at the end of this year or by June 30, 2021, depending on the rate of Fire & Flower’s expansion. It’s looking to almost double its presence to at least 45 outlets by then, according to the deal.

RBC Dominion Securities Inc.’ analysts said their favourable investment thesis on Couche-Tard has been predicated on heightened inside store performance as the retailer pursues its five-year plan to double its earnings before interest, taxation, depreciation and amortization, or EBITDA, through a combination of organic network performance and acquisitions.

“The agreement with Fire & Flower is consistent with previously articulated strategy, and builds on a first partnership announced earlier this year with Canopy Growth to operate “Tweed” branded stores,” RBC analysts said in a note to clients.

Couche-Tard stock was virtually flat at $81.11 on the Toronto Stock Exchange, while Fire & Flower was trading up almost 10 per cent at $1.25 on the TSX Venture Exchange on the news.

The deal will also see Fire & Flower move to a TSX listing under the symbol FAF, the companies said.

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.