You are here

Home 🌿 Recreational Marijuana News 🌿 Legal Canadian market expected to peak by 2026: report 🌿Legal Canadian market expected to peak by 2026: report

Canada doesn't have a lot of time until its cannabis market hits its ceiling.

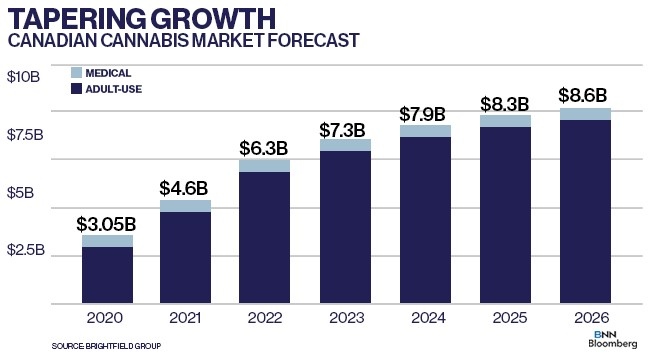

Brightfield Group expects Canada's cannabis market will peak around 2026 to the tune of about $9 billion in annual sales, a time by which the cannabis consultancy sees enough retail stores open to handle demand while enough consumers have successfully transitioned to the legal market, according to a new report.

"The massive growth that we've seen this year and the next probably year or two is going to taper off because ultimately, there's only so many new users that are coming online over the longer term," said Jamie Schau, insights lead at Brightfield Group and the lead author of the report, in a phone interview.

Now, growth is expected to continue at a solid pace for the next couple of years with more stores set to come online in Ontario, B.C., and other provinces. But as Schau points out, the number of restrictions imposed in the Canadian market – such as THC potency limits on edibles – will continue to place a hard ceiling on how big the industry can get.

The report also states how advertising and packaging restrictions set by the federal government have had a significant impact on the sector, which limits competitors' ability to differentiate their products – from both the legal market and their illicit counterparts – as well as help to ease stigma and garner customer loyalty. Other regulations that could be eased to help foster further growth include lowering tax rates, allowing for more efficient licensing, and less provincial "middle-men" in the supply chain, the report said.

Tweaking those restrictions would help to generate more sorely-needed tax revenue for provincial and federal governments, Schau added.

"A huge part of the market is heavier, more experienced users and 10 milligrams of THC is just simply not what they're looking for," Schau said. "Essentially, they've got to leave the legal market for the products that they want."

Schau - who has been studying international cannabis markets for the past six years at Brightfield - did highlight that Canada's cannabis beverage sector is poised for rapid growth over the next few years. She points out how major alcohol brands such as Molson Coors and Constellation Brands have entered the market with heavy investment in creating pot-infused beverages, but may be frustrated by the limitations on how many individual drinks consumers can buy.

"We expect down the line that the conversation between the government and industry will take place because there's a tremendous amount of interest in changing the rules to appeal to legal users for that infused product," she said.

Other potential opportunities that the Canadian cannabis industry could pursue include a greater variety of edible products such as more savoury and baked options, higher potency vapes, and smaller pre-rolls in larger pack sizes, the report finds. As well, more work needs to be done to help brands stand out given that one-quarter of Canadian cannabis buyers surveyed earlier this year by Brightfield said "all cannabis brands are pretty much the same" and a similar percentage were unsure of what dosage they preferred.

"At the end of the day, when your consumer is just looking for an excuse to be able to consume legally, you can pretty much put any product out there and it'll fly off shelves," Schau said.

"But now that it's regulated and sophisticated consumers are looking for frankly a better quality product, you can't pull that off anymore. You can't just throw a product at the wall and hope it sticks."

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.