5 Marijuana Companies To Watch In 2018

It used to be taboo.

Now, cannabis is poised to take 2018 by storm.

Only a few years ago, marijuana was seen as a ‘’gateway drug’’.

Flash forward to today: cannabis is a huge business, one that could be worth $25 billion in the U.S. alone by 2020, and analysts expect demand to skyrocket as new laws are passed and social attitudes change.

In the United States, the legal cannabis industry is worth $6.7 billion, according to Bloomberg. A dozen states have passed more relaxed laws and in October 2017 public support for legalizing marijuana reached an all-time high of 64 percent.

In Canada alone, cannabis is estimated to become an $8 billion market with 300,000 people using marijuana for medical purposes today. When pot is legalized by the Canadian federal government this year, that number could double virtually overnight…to say nothing of the 5 million Canadians who use pot recreationally.

Demand could increase dramatically after pot is legalized for recreational purposes in the coming months.

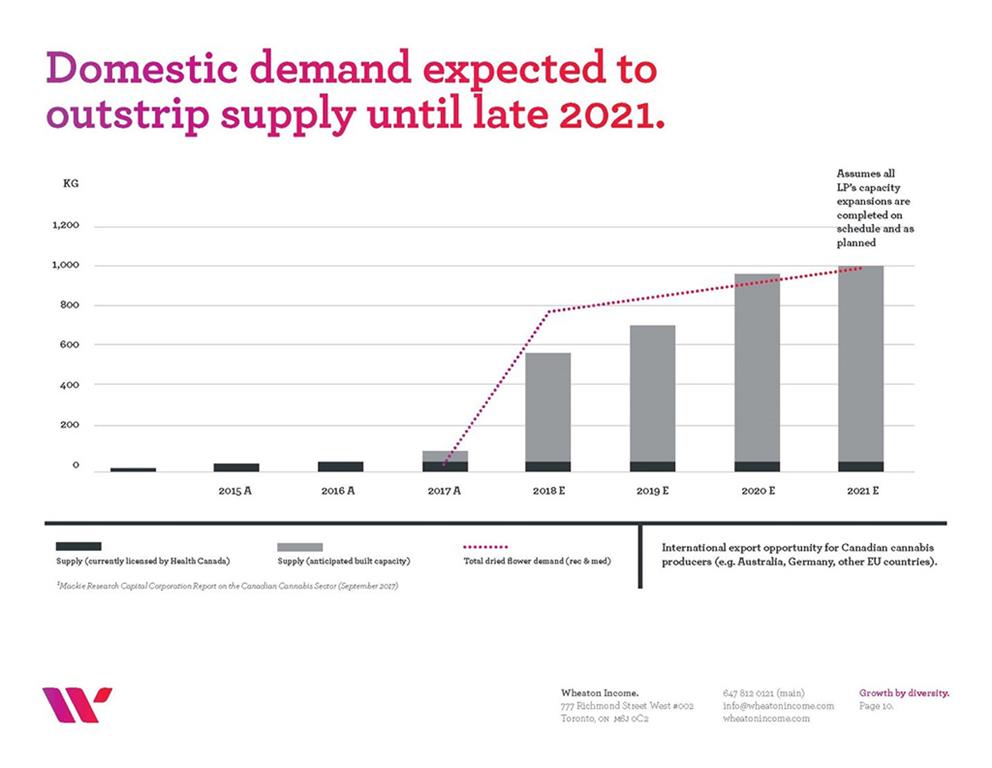

By 2021, there could be 3.8 million legal users consuming 420,000 kilograms of pot.

While the potential for growth is huge, the legal cannabis industry is still in its infancy. At the moment, legal growers supply only 60,000 kilograms of Canada’s weed, or 7 percent of anticipated total medical and recreational demand.

Only $220 million was invested in cannabis in 2016. Yet that’s a significant increase from investment in 2013, which was a scant $13 million. In 2018 alone, there has already been over $1 billion raised by publicly traded cannabis companies in Canada.

It can be a challenge to invest in cannabis. Most publicly-traded firms are small-caps, and some are downright speculative. The immense enthusiasm for cannabis in early 2018 has led to fears of a bubble forming.

But that doesn’t mean that major opportunities aren’t out there, waiting to be seized. Marijuana has become one of the most exciting investing sectors in North America, and that buzz won’t go away any time soon.

Smarter investors can look for ways to profit from the rise in cannabis without exposing themselves to too much risk. This presents some unique opportunities to get in on the ground floor, especially when you look at new and specialized growers and the likelihood that larger firms, particularly those in the tobacco trade, will get in on the action as well.

Here’s a look at some companies that are getting into the cannabis game:

1) Philip Morris (NYSE:PM)

Investors often look to Big Pharma to find solid plays in the booming cannabis sector, but alternatively, they should be looking at Big Tobacco.

Back in the 1960s, when social interest in marijuana began to grow, rumors circulated that Big Tobacco was buying up brand names for marijuana products. But the government crackdown on drugs put that on the backburner.

Now, Big Tobacco is looking to get back into the marijuana market, since it’s clear that big money could be at stake. As cigarette smoking declines, Big Tobacco has started pushing e-cigarettes. Now they could do the same with marijuana.

Philip Morris is no exception. As its stock declines with news of falling cigarette sales, the massive tobacco firm can tell which way the wind is blowing.

Its 2016 investment in Israel’s Syqe Medical was the 2nd largest deal in the cannabis space that year. It plans to invest $20 million in Syqe Medical.

The company now owns a patent for a GMO plant with high terpenes, with application in the medical marijuana market.

As Tobacco markets have grown more mature, the company has been exploring reduced-risk smoking products, with its heated-tobacco iQOS system currently under consideration by the U.S. Food and Drug Administration as a “modified risk tobacco product.”

Philip Morris is playing it safe: it continues to argue that marijuana is illegal and does not constitute a safe investment.

These are quiet moves, but wise investors know that Big Tobacco will make a move into marijuana as soon as the waters are right.

2) Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF)

Without question, the biggest frontier in the marijuana market is Canada.

The country is looking at full legalization by late Summer 2018, which would make it the world’s first federally regulated major marijuana sector.

No Canadian cannabis company is growing as quickly as Cannabis Wheaton. The company’s unique approach to fight the supply deficit takes a leaf out of Netflix’s book: “streaming weed,” where the company offers growers capital to build out or expand their cultivation facilities in return for a minority equity interest and a “stream” of cannabis.

The company is also “vertically-integrated,” with investments throughout the cannabis supply chain from “upstream” production to “downstream” marketing and distribution.

It’s bringing the old Big Oil playbook to the cannabis sector: cover every part of the chain to reduce costs and maximize profits.

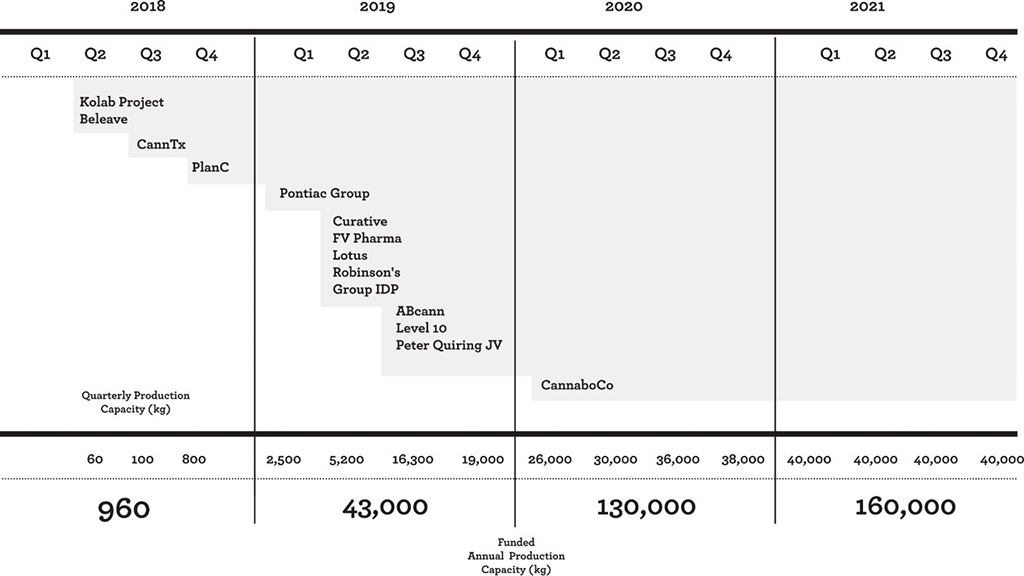

CBW has producers lining up. The company has over 15 partners, with 17 facilities and a potential 2.0 million effective square feet of productive acreage.

In exchange for the capital invested, CBW gets some of the producer’s shares and a percentage of all of the cannabis produced.

CBW has established relationships with 39 clinics already and has access to 30,000 registered medical marijuana patients.

The cannabis market in Canada is expected to explode, what with legalization just around the corner. Cannabis Wheaton anticipates that demand will outstrip supply to 2021.

With that in mind, Cannabis Wheaton is pushing more money into upstream investments. It acquired Dosecann Inc., a dealer with a 42,000 square foot facility on Prince Edward Island. In late 2017, it purchased RockGarden, another licensed producer (since renamed KoLab Inc.).

And just in the past few weeks, Cannabis Wheaton picked up Robinson’s Cannabis Inc., a producer that is close to completing a 27,000 square foot cultivation facility.

With these new acquisitions and falling production costs, Cannabis Wheaton expects revenue to significantly increase as their partner’s facilities come online through 2018 and 2019.

The management at Cannabis Wheaton knows the legal marijuana sector better than any other company out there. CEO Chuck Rifici co-founded Canopy Growth Corp. (formerly Tweed Marijuana Inc.) which has a current market cap of over $6.0 billion.

There is strong political support for CBW’s unique business model, which could prevent a major supply deficit in cannabis once it becomes legal for recreational use in 2018.

With support like this, a strong model and high potential for immense growth once legalization takes off, Cannabis Wheaton is definitely a cannabis stock to watch.

3) Altria Group (NYSE: MO)

This tobacco giant controls more than half of all cigarette sales in the U.S. and, like Philip Morris, might be on the verge of entering the marijuana business.

Falling cigarette sales and changing regulation could drive the company to a rapid change of strategy.

The way forward could be through vaping, which has seen a significant increase in popularity in recent years, particularly among younger users. Since 2016, Altria has invested heavily in vape technology and continues to watch marijuana legislation very closely.

Altria, a solid earner with a great dividend, has been able to keep shareholders happy by raising prices. But this can’t last forever, and rising competition from vape manufacturers and poor quarterly performance will soon force a change in the company’s strategy.

Altria is the best-equipped company to take advantage of marijuana’s increasing legality. It owns many excellent cigarette brands and has massive financial resources. Right now it spends almost nothing on advertising, since most tobacco ads are prohibited.

It’s net revenue ($14.2 billion in 2016) and $200 capex put it in a good position to enter the cannabis sector through MA acquisitions.

Altria is bound to turn to cannabis, and many analysts predict that it will, along with other Big Tobacco firms like Philip Morris, embrace the new drug sooner rather than later.

4) Insys Therapeutics (Nasdaq: INSY)

Along with Big Tobacco, the industry which is sure to embrace cannabis is Big Pharma.

Weed’s breakthrough came in the medical sector, as marijuana emerged as a popular and effective medical treatment. Nowadays, medical marijuana is prescribed for a wide range of ailments such as pain, depression, anxiety and glaucoma.

While not a marijuana stock per se, Insys Therapeutics is on the cutting edge of the emerging trends in medical marijuana research and development.

The company has two drugs approved by the U.S. FDA, named Subsys and Syndros. Syndros uses tetrahydrocannabinol (THC), a compound found in marijuana, to treat patients suffering from seizures.

With the DEA determining synthetic THC to be safer and more manageable than cannabis, which remains illegal on the federal level, Syndros could quickly gain traction in U.S. markets.

The company has been quite successful marketing these products, and looks set to invest some of its significant cash flow (it had $236.7 million in-hand at the end of 2016) into new research and development of cannabis-related drugs.

The company has faced some severe headwinds in 2018, as its stock tanked in March. The reason? Growing concerns over the national opioid epidemic in the United States.

Nevertheless, Syndros sales got off to a great start in 2017 and the drug should prove a strong earner for Insys this year

Right now, the stock is depressed. Investors should snap it up before it makes a comeback later this year.

5) GW Pharmaceuticals (Nasdaq: GWPH)

With its $3 billion valuation and a strong track record, GW Pharmaceuticals is probably the biggest firm entering the cannabis space.

GW has developed a number of new products in recent years, including drugs aimed at epilepsy, infantile spasms, autism and schizophrenia.

But the company’s new drug Epidiolex is about the make history: the experimental product, used to treat childhood epilepsy, could be the first marijuana-based epilepsy drug to get federal approval in the United States.

The FDA panel ruled unanimously that the drug’s benefits outweigh the potential risks. The decision would be a game changer and could open the floodgates for dozens of other marijuana-based treatments to receive federal approval.

The market for the drug might appear small (there are only 20,000 children afflicted with epilepsy), but nationwide more than 2.4 million Americans suffer from the disease. GW could earn $500 million from sales of the drug. And that’s just the beginning; other marijuana-based products could tap into much larger markets.

The company’s fundamentals are strong, bolstered by its strong presence in the UK, where it’s based.

The company plans to invest £50 million and hire 70 new staff for its Britain-based facilities.

The decision for Epidiolex could mark a revolution in medical marijuana treatments. And GW Pharma is poised to take full advantage.

Other companies to keep a close eye on in the space:

Aphria (TSX:APH) is a Canada-based cannabis company which focuses on the production, sales, and distribution of legal marijuana. The company’s business model focuses primarily on online sales, which is perfect for its patients. A simple point and click and the medication will arrive at the patient’s in no time.

Aphria’s products are developed to treat to a variety of different patients and symptoms. The company offers several smoke free medications for those who are unable to consume the products in that manner. Aphria also produces low-THC products for patients who are more sensitive to marijuana’s psychoactive properties.

Aphria’s large market appeal make the company an ideal choice for investors, as the company is sure to retain, as well as grow their customer base over time.

THC Biomed International Ltd (CSE:THC) operates as a licensed producer under Canada's Marihuana for Medical Purposes Regulations. It is also engaged in the research & development of the products and services to medical marijuana.

THC’s share price bounced back in November after the company announced the creation of THC2Go dispensaries – a fully owned subsidiary, focused at the retail cannabis products – in the province of Manitoba.

Harvest One Cannabis (TSXV:HVT): Harvest One Cannabis Inc, formerly Harvest One Capital Inc, is a Canadian company focused on servicing both recreational and medicinal markets.

Harvest One recently raised $25 million in equity financing and $9 million will be used to finance Phase 1 production capacity expansion at United Greeneries’ Duncan Facility.

Harvest One has seen its share price increase in September and we think the company is well-positioned to take advantage of Canada’s looming legalization of recreational marijuana.

Aphria Inc (TSX:APH): Aphria Inc is engaged in the production and selling of medicinal marijuana, and while the stock has trended downward since April, the constant profits here suggest there is a lot of upside. The recent pro-marijuana legislation from the Canadian government is sure to boost companies with the reputation of Aphria Inc.

Aphria’s $137 million expansion project is well underway to ramp up output to 70,000 kg. If Aphria successfully ramps up production, we believe its share price could go much higher.

Beleave (CSE:BE): Beleave is a biotech company focused on the production of medical marijuana in Canada. Its wholly-owned subsidiary, First Access, applied for a pre-license inspection in March 2017.

Beleave became Cannabis Wheaton’s fifth production partner in May and the parties will work cooperatively to identify an appropriate second site to be acquired and developed by a newly formed special purpose subsidiary of Beleave ("NewCo"). The proposed second site is expected to be located in Ontario and will be designed to accommodate an estimated 200,000 square feet of cultivation space.

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.