Five key takeaways from Ontario's annual cannabis report

Five key takeaways from Ontario's annual cannabis report

The Ontario Cannabis Store released its annual report looking at the state of the province's cannabis market earlier this week. The report is chock-full of interesting tidbits and nuggets of information which will likely be pored over by industry observers looking for guidance on where the $2.6-billion cannabis market is heading. Given that federal regulators and Statistics Canada don't provide such a detailed look at how sales of cannabis fare in the country, and given also that Ontario is the biggest retail market in Canada and has a highly influential role within the broader industry, this report is the best indicator of how policymakers view the market. Simply put, Ontario's view on the cannabis industy matters.

An interview request with interim Ontario Cannabis Store Chief Executive Officer David Lobo was declined, citing the “interim” status of his position.

Here's five interesting items that we were able to gleam from the report:

Legacy market stubbornly persists: The OCS estimates that 44.1 per cent of the province's cannabis sales came from the legal market by the fiscal fourth quarter (which ended March 2021), with the rest occurring among illicit channels. That's slightly up from the 43.1 per cent observed in the prior quarter, and a sign that the transitioning of customers from the legacy market to the legal one has slowed down considerably. While a bevy of new cannabis stores will likely keep that transition happening, the slower pace suggests illicit operators continue to flourish despite ongoing enforcement in the industry.

Store closures are (probably) coming: You may not be the only one wondering about the concentration of some legal pot stores in parts of the province, particularly in Toronto. Lobo notes in his annual letter that the industry's rapid growth “will likely result in some retailers being faced with increased competition and a crowded marketplace, which could result in some closures and market right-sizing.” While some areas may benefit from a clustering of cannabis retailers according to some academics, the province continues to take a market-based approach on retail, with no plans to restrict or reduce the amount of licensed pot stores. Lobo goes on to say that retailers will need to "further drive a relentless focus on targeted consumer segments and differentiating themselves from others."

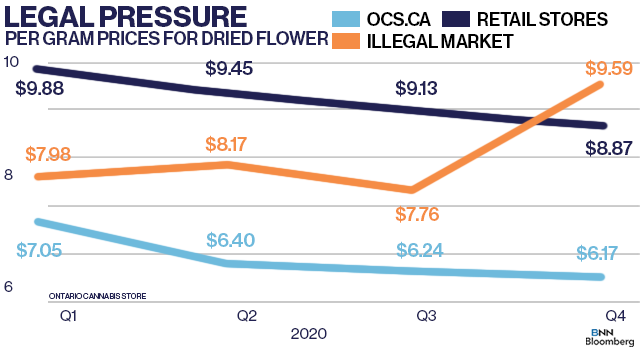

Prices keep dropping: The legal market continues to make strides in pricing, with the average price per gram sold by the OCS online hitting $6.17 at the end of March compared to $7.05 at the beginning of April 2020. Meanwhile, retail prices fell to $8.87 from $9.88 during that same time frame. Interestingly the average price of a gram of cannabis in the illicit market soared to $9.59 at the end of March from $7.98 in April 2020; the OCS says the increase might be the result of illicit sellers pushing more expensive, premium products and the removal of some websites illegally selling cannabis online. When it comes to the "value" end of cannabis, however, the OCS found consumers are buying slightly more premium products as retail store associates influence more people to purchase higher-priced offerings.

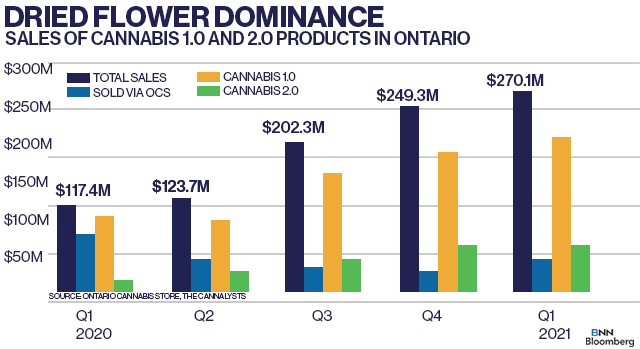

Flower continues to dominate: Despite the availability of a wide-range of innovative cannabis products, the vast majority of pot sales in Ontario remain dried flower and pre-rolls. Roughly 71 per cent of all sales came from these two categories, according to independent analysts at The Cannalysts. They also said in a report to clients that the dried flower category remains competitive among retailers and producers alike, while pre-roll sales likely saw a boost due to "impulse/convenience" purchases at retail stores.

Does anyone like pot drinks?: Despite all the hoopla, sales of most Cannabis 2.0 products continue to grow at a modest pace. Topical product sales saw a 12 per cent quarterly rise, but only amounted to about $4.5 million for the entire year. Concentrates, a category that includes products such as resin, hash and shatter, saw a steady 16 per cent rise in sales from the prior quarter, but totalled only $17.5 million or about three per cent of the year's total sales. More surprising was how infused beverages performed over the year; while producers have spent millions developing pot drinks, they only represent two per cent of the entire market or $12.8 million in sales and The Cannalysts report sees sales growth dropping by six per cent in the quarter.

420 Intel is Your Source for Marijuana News

420 Intel Canada is your leading news source for the Canadian cannabis industry. Get the latest updates on Canadian cannabis stocks and developments on how Canada continues to be a major player in the worldwide recreational and medical cannabis industry.

420 Intel Canada is the Canadian Industry news outlet that will keep you updated on how these Canadian developments in recreational and medical marijuana will impact the country and the world. Our commitment is to bring you the most important cannabis news stories from across Canada every day of the week.

Marijuana industry news is a constant endeavor with new developments each day. For marijuana news across the True North, 420 Intel Canada promises to bring you quality, Canadian, cannabis industry news.

You can get 420 Intel news delivered directly to your inbox by signing up for our daily marijuana news, ensuring you’re always kept up to date on the ever-changing cannabis industry. To stay even better informed about marijuana legalization news follow us on Twitter, Facebook and LinkedIn.